Advocacy through the Years

Since its inception, the Georgia Trust has supported public and private advocacy in a variety of ways. From the creation of the Georgia Historic Preservation Act and the Georgia Main Street Program in the late 1970s and early 1980s, to lobbying for both the state and federal Historic Preservation tax credits, the Trust advocates for laws, programs, and policies that promote the preservation of Georgia’s historic resources. Throughout its history, the Trust has also overseen Georgians for Preservation Action (GaPA), the statewide council for historic preservation advocacy, most recently advocating to save the State Historic Tax Credit, which had been set to sunset at the end of 2022 but was fortunately extended.

Since its inception, the Georgia Trust has supported public and private advocacy in a variety of ways. From the creation of the Georgia Historic Preservation Act and the Georgia Main Street Program in the late 1970s and early 1980s, to lobbying for both the state and federal Historic Preservation tax credits, the Trust advocates for laws, programs, and policies that promote the preservation of Georgia’s historic resources. Throughout its history, the Trust has also overseen Georgians for Preservation Action (GaPA), the statewide council for historic preservation advocacy, most recently advocating to save the State Historic Tax Credit, which had been set to sunset at the end of 2022 but was fortunately extended.

Georgia Historic Preservation Act

Nationally prominent by the mid-1970s, the Georgia Trust’s role as a leader in historic preservation was not limited to mere restoration and revitalization of historic properties across the state. In addition to these foundational efforts to preserve and protect Georgia’s history on the ground, the Georgia Trust also encouraged policymakers in the Georgia legislature to pass laws benefitting the cause of historic preservation. One such law is the Georgia Historic Preservation Act, passed in 1979, which allowed local governments to establish preservation zoning commissions. This critical piece of legislature accelerated preservation efforts and activity in Georgia.

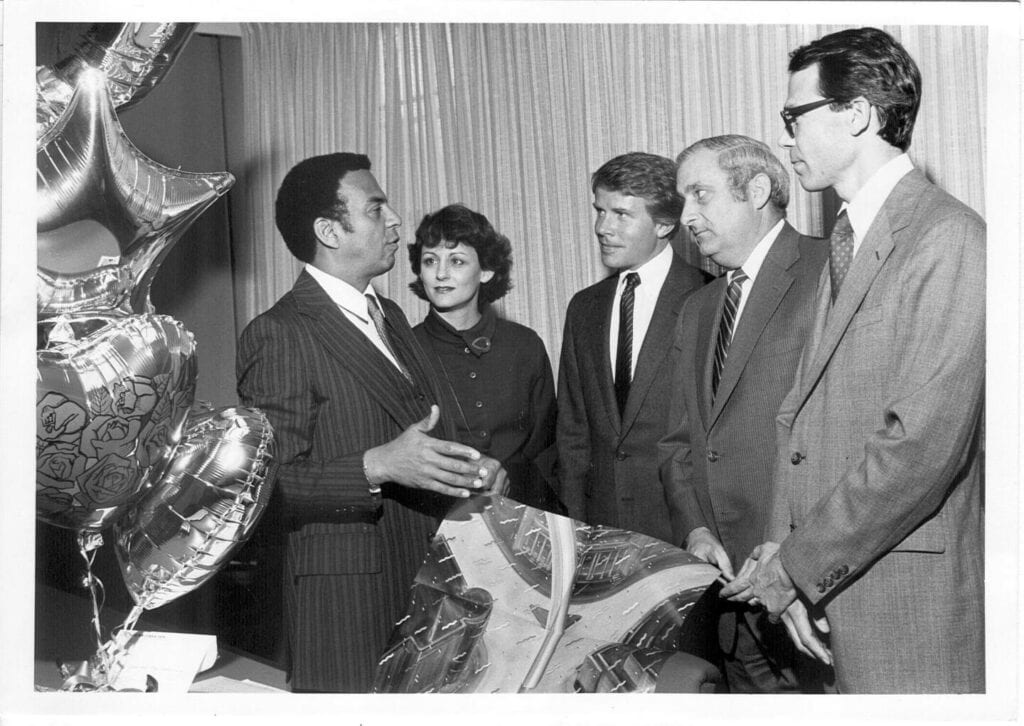

Georgia Main Street Program

In 1980, Georgia was one of only six states chosen to participate in the national Main Street Project to help smaller cities and towns revitalize their downtown areas. The five target cities were Athens, Canton, LaGrange, Swainsboro and Waycross. The Georgia Trust created the Main Street Design Assistance Program in 1981 to address the design component of the Main Street approach, and Trust staff visited downtowns across the state to help with projects under consideration in cities such as Thomasville, Americus, Griffin, Madison, Rome, Dalton and Carrollton. In the first three years of the program, 250 buildings were rehabilitated. Georgia now has 105 designated Main Street cities, and the projects have proven to be catalysts for economic revitalization in downtowns across the state.

Georgia Historic Tax Credit

The Georgia General Assembly passed the Georgia State Income Tax Credit for Historic Rehabilitation in 2002. This law, which went into effect January 1, 2004, provided a 10% tax credit for rehabilitating residential properties and a 20% tax credit for commercial/income-producing properties, with a $5,000 maximum allowable credit per project. Administered by the Georgia Historic Preservation Division, the incentive spurred many successful rehabilitation projects, and by 2009, the tax credit was increased to 25%, with new caps of $100,000 for a personal residence and $300,000 for all other projects. In 2016, the incentive was further increased, allowing higher project credit caps of $5 million and $10 million for large-scale development projects.

Constructed in 1926 as the Sears, Roebuck & Company Southeast distribution center and retail store, this historic building in Atlanta was rehabilitated for Ponce City Market in 2014.

The Ponce City Market project leveraged over $50 million in state and federal tax credits which helped provide equity for the success of the project and made it one of the largest preservation projects in the nation’s history.

Support the Georgia Trust’s ongoing advocacy efforts by becoming a member today!

See more about the history of the Georgia Trust on our 50th Anniversary blog Celebrating 50.